Who Needs to Sign? Signing Authority in Estates, Trust, and LLCs

By: Jessica O. Wilke

Partner, Hansen, Howell & Wilkie, PLLC

North Carolina Underwriting Counsel, Alliant National Title Insurance Company

I. Why do we care?

A. Because claims / litigation due to lack of authority or capacity in signing real property

documents are costly and on the rise.

B. We want to protect our clients and ensure they get good title.

C. A real property transaction starts long before the deed gets signed and the closing happens –

who is retaining the real estate agent? Who is signing the offer to purchase and contract? The

sooner in the process you identify the proper parties, the smoother things will (should?) go.

II. Limited Liability Companies

A. The new North Carolina Limited Liability Company Act (NCGS Chapter 57D) took effect Jan. 1, 2014

and replaced the old LLC Act (Chapter 57C). Chapter 57D applies to every LLC, whether formed on,

before, or after that date. N.C. Gen. Stat. § 57D-11- 01.

B. Under the New Act, when forming an LLC via Articles of Organization, there is no option to

select if the LLC is member-managed or manager-managed. The Operating Agreement (“OA”) should

control that. If there is no OA, or it is silent, then all members are managers. NCGS §

57D-20-3(d). OA can specify managers or other company officials and their duties.

C. The Operating Agreement of an LLC controls. It may be in writing but note that under the New

Act, OAs much of OAs can be oral or implied.

D. If there is no written OA, then the New Act controls. If there is a conflict between the OA and

the Articles of Organization on file, then the OA controls – but Articles of Organization prevail

as to extent that a 3rd party reasonably relied on it. NCGS § 57D-2-30(d).

E. Each manager has equal rights to participate in the management of the LLC and its business.

57D-3-20(a)-(b), (d). Further, although the "manager[s] may act on behalf of the LLC in the

ordinary course of the LLC's business" and "may make management decisions without a meeting and

without notice," this authority is subject to the Act's mandate that "management decisions

approved by a majority of the managers are controlling." N.C. Gen. Stat. § 57D-3-20(b)-(c).

Emphasis added.

F. Under the New Act, Managers can delegate management authority unless OA

prohibits it. NCGS § 57D-3-33. Delegation may be general or specific. (Per the Old Act: OA must authorize delegation of authority.) This delegation can be to other persons and/or via

a Power of Attorney. See also NCGS Chapter 32C, which includes the grant of general authority for

“Operation of Entity or Business” in the statutory for. NCGS § 32C-3-301.

G. Status of LLC

1. Generally in a real property transaction – especially a purchase or refinance – an LLC must be

in good standing (no dissolved or suspended).

2. Note that LLCs can still continue business after dissolution as part of “winding up.” NCGS §

57D-6-07. So a transfer of real property from a dissolved LLC does not necessarily require that the

LLC be reinstated.

3. HOWEVER if the dissolution or suspension was tax-related, this must be addressed before it may

dispose of real property or conduct other business, as any act performed during the period of

suspension is invalid and of no effect. See NCGS § 105-230.

H. Foreign LLCs

1. A foreign LLC must obtain a certificate of authority from the Secretary of State in order to

transact business. NCGS § 57D-7-01(a). However, merely owning real property is not considered

transacting business. NCGS § 57D-7-01(b)(11). What about buying and selling real property? Probably

need a certificate of authority. Note that “the failure of a foreign LLC to obtain a certificate of

authority does not impair the validity of its acts[.]” § 57D-7-02(c). So a BFP would get good title

even if the foreign LLC failed to obtain a certificate of authority.

2. You obtain a certificate of authority from the Secretary of State (see

https://www.sosnc.gov/Guides/register_a_foreign_business). Generally the foreign entity will need

to complete paperwork, provide the names and titles of the officers, and submit a Certificate of

Existence from the state of formation. See also NCGS § 57D-7-03.

I. Takeaways:

1. Read the Operating Agreement! Who is identified as a manager or company official? Who needs to

sign?

2. If there is no Operating Agreement – then all members are managers, and a MAJORITY will be

required to join in a conveyance.

III.Trusts

A. Generally governed under NCGS Chapter 36C (after 36, 36A repealed). The terms of the Trust

prevail over Chapter 36C except for those provisions listed in § 36C-1-105.

B. A Trust consists of:

1. Settlor: creates or funds the Trust

2. Beneficiary: has some interest in a Trust

3. Trustee(s): has duties and authority relating to administration of the Trust

C. Most important questions to ask when handling a sale or refinance of real property that is

purportedly within a Trust:

1. What does the Trust say?

2. Who are the Trustees?

D. If the Trust documents cannot be found: judicial intervention may be required - the Court may

need to take steps, including but not limited to amending, revoking or reforming the Trust.

E. If there are claims against the individual Settlor, the type of Trust is important. For example,

when the Settlor is alive, the property of a revocable trust is subject to claims of creditors.

NCGS §36C-5-505.

F. The Trust should state under what circumstances real property can be disposed of, transferred,

or distributed; if approval is needed; if accounting is needed; etc.

G. The Trust should also state if one Trustee may act alone, or if ALL Trustees may act, or if a

majority of Trustees must consent, etc. If it is not specified: see NCGS §36C-7- 703: Cotrustees

who are unable to reach a unanimous decision may act by majority decision if more than two are

serving. Unanimity is required when only two cotrustees are serving.

H. The General and Specific powers of trustees are listed in NCGS §§36C-8-815 and 816 respectively;

816(2), (8), (8), (10) are most relevant for real property transactions.

I. Reliance and Certification

1. See NCGS §36C-10-1012: a person who in good faith and value relies on / deals with a trustee is

protected from liability.

2. NCGS §36C-10-1013: Certification of Trust. A trustee may furnish a Certification of Trust rather

than an entire Trust Document. These should be obtained and recorded in real property transactions.

3. Who is preparing the Certification?

J. See NCGS § 39-6.7 for how to deal with conveyances that purport to transfer to a Trust (without

naming a Trustee) or fail to include a designation of “Trustee.”

K. Takeaways:

1. Read the Trust! Not all Trusts do what the Trustees / Settlors / Beneficiaries think they do.

2. If not available, rely on a recently executed Trust Certificate

3. BE CAREFUL if you are preparing the Trust Certificate (again, Trusts can be tricky)

IV.Estates

V. The Basics

A. When someone dies owning real property, how does title pass?

1. First, figure out what interest that person held at death:

a. Tenancy by Entirety (TBE)?

b. Joint Tenancy with Right of Survivorship (JTROS)?

c. Life Estate?

d. Tenant in Common (TIC)?

e. Sole owner in fee simple?

2. If the decedent owned title as TBE with a spouse, or as JTROS, or held a life estate, then the

decedent’s interest in the real property terminated at death, and the real property is not part of

the decedent’s estate in any way.

3. If the decedent owned property as a TIC or as the sole owner in fee simple, then his or her interest will pass to heirs (without a will) or devisees (by a will). (Note that the layperson’s definition of “heir” is usually anyone who inherits property.)

4. Note that if two or more persons (who are not married to each other) own real property, the

presumption is that they have title as TIC unless language in the vesting deed indicates JTROS. Be

careful: sometimes the language is inexact – Tenants in Common with Right of Survivorship, etc.

What does that really mean? Intent will control. See Daniel R. Tilly & Patrick K. Henrick, North

Carolina’s Reincarnated Joint Tenancy: Oh Intent, Where Art Thou, 93

N.C. L. Rev. 1649 (2015) ) See also 2019 Senate Bill 595, which was an attempt to clarify creation

of JTROS.

B. If the decedent has no will (OR if the will is ineffective to pass property), then title to real

property vests in the heirs at law at the death of the decedent.

1. Chapter 29 of the NCGS covers intestate succession.

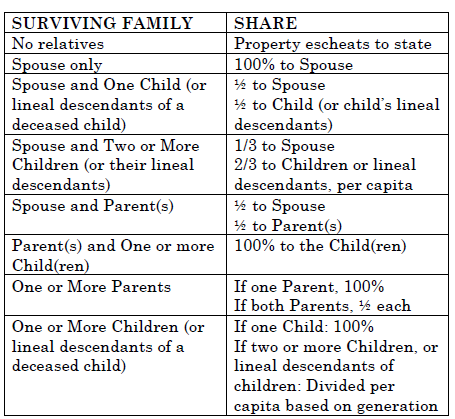

2. For real property: share of persons who take upon intestacy: See NCGS §§ 29-15, 29-15

See NCGS §§ 29-15, 29-15

3. But note: children born out of wedlock can inherit under Chapter 29 from mother – but only from

father in certain circumstances. See NCGS Article 6, §§ 29-19 et seq.

C. If the decedent has a will, and the will is probated, then title to the real property vests in

the devisees upon successful probate, and the vesting relates back to the death of the decedent

(subject to § 31-39). NCGS § 28A- 15-2(b).

D. NCGS § 29-8: “If part but not all of the estate of a decedent is validly disposed of by the decedent's will, the part not disposed of by such will shall descend and be distributed as intestate property. ” Nonetheless, the law does not favor intestacy.

VI. Estate Administration

A. Unless real property is willed to the estate, then it’s not part of the “probate” estate.

HOWEVER, Medicaid considers real property (not TBE) owned by the decedent at death to be part of

the probate estate. AND if the liquid assets of the estate are not sufficient to satisfy claims

against it, the personal representative (PR) (which is the executor or administrator) can have real

property “brought into” the estate. Layperson’s use of “probate” generally means everything they

leave to their heirs, and that can create some issues in will drafting. Again, there is a

presumption against intestacy. See cases citing NCGS § 31-40.

B. If real property is to be sold, an estate *probably* needs to be opened in the county in which

the real property is located.

1. If the decedent lived outside of NC at the time of death, a certified copy of the will (or the

original) must be probated in the proper NC county pursuant to an ancillary administration. NCGS §

28A-26-1 et seq.

2. If the decedent lived outside of NC at the time of death and did not have a will, and if it has

been less than 2 years since the death, an ancillary administration is needed in the county where

the real property is located.

3. If the decedent lived in NC at the time of death and opened an estate by probating a will in a

county other than where the real property is located, then a certified copy of the will and

certificate of probate must be filed in the county where the property is located. § 28A-2A-13.

4. To be probated the will must be self-proving or additional steps must be taken. (See for AOC

E-309 and § 31-11.6(d) for out of state wills)

5. Timing should be considered. In some counties (like Wake), you can only open an estate with an

appointment, and those can take weeks to secure.

6. Notice

a. Notice “shall be published once a week for four consecutive weeks in a newspaper qualified to

publish legal advertisements, if any such newspaper is published in the county.” If there is no

such paper, but there is one with general circulation in the county, notice must be published once

a week for four consecutive weeks, plus at the courthouse, OR at the courthouse and at four other

public places in the county. NCGS § 28A-14-1(a).

b. Special rules if decedent received Medicaid benefits. NCGS § 28A-14- 1(b).

c. If notice has not been run within 3 years of the death of the decedent, then all claims (other

than those by US or for NC taxes) are barred. NCGS § 28A-19-3(f).

7. If the claims against the estate exceed the liquid assets of the estate, then the PR can sell

the real property to satisfy the claims:

a. Without a will, the administrator will need to petition to have the property sold. This is a

defeasance of the heirs’ property. The property can be sold via a special proceeding. NCGS §

28A-15-1, § 28A Article 17.

b. With a will:

i. If the will leaves the real property to devisees, then the executor will have to petition to

sell the property, as above. Again, this is a defeasance of the devisees’ property.

ii. If the will devises the real property to the executor/PR OR includes legally sufficient

language allowing the PR to sell the property without bringing a special proceeding, then the PR

may do so. **This is tricky and a careful review of the language used in the will is vital.

iii. For further reading: see James v. James, 58 N.C.App. 371, 293 S.E.2d 655 (1982); Montgomery

v. Hinton, 45 N.C.App. 271,

262 S.E.2d 697 (1980)

iv. Also: if property vests in heirs or devisees who have liens or judgments against them, these

liens/judgments cannot be avoided merely by the PR trying to sell the real property via a special

proceeding under Chapter 28A

C. Renunciations

1. An heir or devisee can renounce his or her share (or partial share) in an estate by timely

filing of the renunciation. NCGS §§ 31B-1 et seq.

2. The renunciation should be filed in the Clerk of Court’s office and the Register of Deeds

office. It needs to meet federal statutory time periods for federal purposes; for state purposes,

it must be filed within nine months after the date of the transfer (i.e., death of decedent). NCGS

§ 31B-

2(a). If timely filed, the property of the decedent shall pass as though the renouncer died

immediately prior to the decedent – so, by intestacy.

3. If the renunciation is not timely filed, then the property devolves as though the renouncer died

on the date the renunciation was filed. NCGS § 31B-3(a)(2).

4. Special note: a renunciation works as to State claims and other civil claims against an

heir/devisee, but NOT as to federal claims. So if an heir/devisee with federal tax liens signs a

renunciation, the federal lien is still going to attach to the renouncer’s share. See Drye v.

United States, 528 US 49 (1999).

D. Special circumstances:

1. Estates of missing persons: see NCGS § 28C

2. When time has passed since the death of the decedent and no estate has been opened.

VII. Sale of the Real Property

A. Who signs the Offer to Purchase and Contract?

1. Typically the PR does it for convenience, but heirs / devisees should probably sign in most

cases.

2. Lenders have different preferences.

B. Steps Before Closing

1. Title search, including searching judgments against decedent and heirs/devisees. (As state

above, a renunciation works as to State claims and other civil claims against an heir/devisee, but

NOT as to federal claims.) Judgments against the heirs / devisees attach to the real property upon

vesting, and must be addressed before the real property can be sold. This can be shocking to the

heirs/devisees, and sometimes difficult to deal with.

2. Examine the estate file closely, and determine the status of the estate (open, closed); this

will determine who signs the deed, and requirements for any other documents.

3. Check if a surviving spouse took an elective share under NCGS § 29-30 or

§ 30 Article 1A.

4. In most cases you’ll need to identify and find all the heirs or devisees, and this can be a

problem. If they are not local, you need to account for the time it takes to deliver and execute

documents. In cases without a will, Affidavits of Heirship may be required to ensure you have all

the appropriate parties.

C. Who signs the Deed?

1. If the estate has been closed, and the notices properly run, tax certifications are all filed,

and the final account looks good, then the heirs or devisees and their spouses can sign the deed,

and the proceeds can be paid to them according to their shares.

2. If the will leaves the real property to the executor with the power to sell, or directs the

executor to sell the real property, then the executor can sell without bringing a special

proceeding. There is some debate about whether or not joinder of the devisees is required;

typically the devisees do not join in the conveyance. An Open Estate Indemnity Form should also be

signed.

3. If the will leaves the real property to devisees, but the estate is still open, then so long as

the first notice to creditors has run, the devisees (and their spouses) can deed the property – but

they must be joined by the PR. If the time for filing claims has past when the conveyance is made,

then the property can be insured without exception for the claims of creditors. An Open Estate

Indemnity Form should also be signed.

4. Notes:

a. A conveyance made two years after the death of a testator or after the filing and approval of

the final account to innocent purchasers from the heirs at law of the testator shall not be

affected by the subsequent probate and registration of any will. NCGS § 31-39.

b. If a sale of property occurs prior to the first publishing or posting of notice to creditors,

the sale is void as to creditors and PRs. NOT GOOD. This puts title at extreme risk. NCGS §

28A-14-1(a)(1).

c. If a sale occurs after the first publishing but before approval of the final accounting, the

sale is void as to creditors and PRs unless the PR joins in the sale. NCGS § 28A-14-1(a)(2).

D. If notice to creditors doesn’t occur within two years after the date of death, a deed from the

devisees/heirs and spouses is valid as to creditors and PRs. The purchaser’s title will have

priority over later-filed claims of creditors.

VIII. Special Notes

A. When there is patent ambiguity in a will, the Court may need to decide. See Treadaway v. Payne,

279 N.C. App. 664, 866 S.E.2d 479 (2021): "Where parts of the will are dissonant or create an

ambiguity, the discord thus created must be resolved in light of the prevailing purpose of the

entire instrument. In attempting to determine the testator's intention, the language used, and the

sense in which it is used by the testator, is the primary source of information, as it is the

expressed intention of the testator which is sought. To ascertain the intent of the testator, the

will must be considered as a whole. If possible, meaning must be given to each clause, phrase and

word. If it contains apparently conflicting provisions, such conflicts must be reconciled if this

may reasonably be done.” The intention of the testator is the “polar star.”

B. What if one of the decedent’s heirs or devisees dies before the real property is sold – do we

have to address that person’s estate? Yes

C. What if a person signs a contract, and then dies? The PR can complete the contract and convey

the property without court approval – it’s as if the PR steps into the deceased’s shoes. Proceeds

are paid into the estate. NCGS § 28A-17-9.

Statutes / References

Chapter 57D. North Carolina Limited Liability Company Acgt NCGS § 57D-1-03. Definitions.

(5) Company official. - Any person exercising any management authority over the limited liability

company whether the person is a manager or referred to as a manager, director, or officer or given

any other title.

(20) Manager. - Has the following meanings: (i) with respect to an LLC, any person designated as a

manager as provided in the operating agreement or, if applicable, in

G.S. 57D-3-20(d) and (ii) with respect to a foreign LLC, any person designated as a manager under

the law of the jurisdiction in which the foreign LLC is organized.

(21) Member. - A person who has been admitted as a member of the LLC as provided in the operating

agreement or G.S. 57D-3-01, who was a member of the LLC immediately before the repeal of Chapter

57C of the General Statutes until the person ceases to be a member as provided in the operating

agreement or G.S. 57D-3-02, or, with respect to a foreign LLC, a person who has been admitted as

a member of the foreign LLC under the law of the jurisdiction in which the foreign LLC is organized until

the person ceases to be a member under that law.

(23) Operating agreement. - Any agreement concerning the LLC or any ownership interest in the LLC

to which each interest owner is a party or is otherwise bound as an interest owner. Subject to

other controlling law, the operating agreement may be in any form, including written, oral, or

implied, or any combination thereof. The operating agreement may specify the form that the

operating agreement must take, in which case any purported amendment to the operating agreement or

other agreement expressed in a nonconforming manner will not be deemed to be part of the operating

agreement and will not be enforceable to the extent it would be part of the operating agreement if

it were in proper form. Subject to G.S. 57D-2-21 and the other provisions of this Chapter governing

articles of organization, the articles of organization are to be deemed to be, or be part of, the

operating agreement. If the LLC has only one interest owner and no operating agreement to which

another person is a party, then any document or record intended by the interest owner to serve as

the operating agreement will be the operating agreement.

NCGS § 57D-3-20. Management; managers.

(a) The management of an LLC and its business is vested in the managers.

(b) Each manager has equal rights to participate in the management of the LLC and its business.

Management decisions approved by a majority of the managers are controlling. The managers may make

management decisions without a meeting and without notice.

(c) Subject to the direction and control of a majority of the managers as provided in G.S.

57D-3-20(b), each manager may act on behalf of the LLC in the ordinary course of the LLC's

business.

(d) All members by virtue of their status as members are managers of the LLC, together with any

other person or persons who may be designated as a manager in, or in the manner provided in, the

operating agreement. If the operating agreement provides or otherwise contemplates that members are

not necessarily managers by virtue of their status as members, then those persons designated as

managers in, or in the manner provided in, the operating agreement will be managers. The operating

agreement may provide that the LLC is to be managed by one or more company officials who are not

designated as managers. All members will be managers for any period during which the LLC would

otherwise not have any managers or other company officials.

(e) A person shall continue to serve as a manager until the earliest of the following occurs: (i)

the person's resignation as a manager; (ii) any event described in G.S. 57D-3- 02(a) with respect

to the person, substituting therein the term "manager" in lieu of the term "member" for purposes of

this subsection; or (iii) that person, or the member or all of a class or group of less than all of

the members who appointed the person to be a manager, ceases to be a member.

Chapter 36C. North Carolina Uniform Trust Code

§ 36C-10-1012. Protection of person dealing with trustee.

(a) A person other than a beneficiary who in good faith assists a trustee, or who in good faith

and for value deals with a trustee, without knowledge that the trustee is exceeding or

improperly exercising the trustee's powers, is protected from liability as if the trustee properly

exercised the power.

(b) A person other than a beneficiary who in good faith deals with a trustee is not required to

inquire into the extent of the trustee's powers or the propriety of their exercise.

(c) A person who in good faith delivers assets to a trustee need not ensure their proper

application.

(d) A person other than a beneficiary who in good faith assists a former trustee, or who in good

faith and for value deals with a former trustee, without knowledge that the trusteeship has

terminated is protected from liability as if the former trustee were still a trustee.

(e) Comparable protective provisions of other laws relating to commercial transactions or

transfer of securities by fiduciaries prevail over the protection provided by this section.

(f) A person is not required to obtain a certification under G.S. 36C-10-1013 in order to be

entitled to the protections of this section. (2005-192, s. 2.)

§ 36C-10-1013. Certification of trust.

(a) Instead of furnishing a copy of the trust instrument to a person other than a beneficiary,

the trustee may furnish to the person a certification of trust containing the following

information:

(1) The existence of the trust and the date the trust instrument was executed;

(2) The identity of the settlor, unless withheld under a provision in the trust instrument;

(3) The identity and address of the currently acting trustee;

(4) The powers of the trustee;

(5) The revocability or irrevocability of the trust and the identity of any person holding a

power to revoke the trust;

(6) The authority of cotrustees to sign or otherwise authenticate and whether all or less than

all are required in order to exercise powers of the trustee;

(7) The trust's taxpayer identification number; and

(8) The manner of taking title to trust property.

(b) Any trustee may sign or otherwise authenticate a certification of trust.

(c) A certification of trust must state that the trust has not been revoked, modified, or amended

in any manner that would cause the representations contained in the certification of trust to be

incorrect.

(d) A certification of trust need not contain the dispositive terms of a trust.

(e) A recipient of a certification of trust may require the trustee to furnish copies of those

excerpts from the original trust instrument and later amendments that designate the trustee and

confer upon the trustee the power to act in the pending transaction.

(f) A person who acts in reliance upon a certification of trust without knowledge that the

representations contained in the certification are incorrect is not liable to any person for so

acting and may assume without inquiry the existence of the facts contained in the certification.

Knowledge of the terms of the trust may not be inferred solely from the fact that the person

relying upon the certification holds a copy of all or part of the trust instrument.

(g)A person who in good faith enters into a transaction in reliance upon a certification of trust may enforce

the transaction against the trust property as if the representations contained in the certification were correct.

(h) A person making a demand for the trust instrument in addition to a certification of trust or

excerpts is liable for damages if the court determines that the person did not act in good faith in

demanding the trust instrument.

(i) This section does not limit the right of a person to obtain a copy of the trust instrument in

a judicial proceeding concerning the trust.

(j) In transactions involving real property, a person who acts in reliance upon a certification

of trust may require that the certification of trust be executed and acknowledged in a manner that

will permit its registration in the office of the register of deeds in the county where the real

property is located. The certification of trust need not contain the trust's taxpayer

identification number if that taxpayer identification number is also the social security number of

a grantor. However, the trust's taxpayer identification number shall be certified by the trustee to

the person acting in reliance upon the certification of trust in a manner reasonably satisfactory

to that person. (2005-192, s. 2.)

Chapter 39. Conveyances.

§ 39-6.7. Construction of conveyances to or by trusts.

(a) A deed, will, beneficiary designation, or other instrument that purports to convey, devise,

or otherwise transfer any ownership or security interest in real or personal property to a trust

shall be deemed to be a transfer to the trustee or trustees of that trust.

(b) A deed or other instrument which purports to convey or otherwise transfer any ownership or

security interest in real or personal property by a trust shall be deemed to be a transfer by the

trustee or trustees of that trust. This rule of construction shall apply:

(1) Regardless of whether the instrument is signed by the trustee or trustees as such, or by the

trustee or trustees purportedly for or on behalf of the trust; and

(2) Regardless of whether the instrument by which the trustee or trustees acquired title

transferred that title to the trustee or trustees as such, or purportedly to the trust.

(c) A deed or other instrument by which the trustee or trustees of a trust convey or otherwise

transfer any ownership or security interest in real or personal property shall be deemed

sufficient:

(1) Regardless of whether the instrument is signed by the trustee or trustees as such, or by the

trustee or trustees purportedly for or on behalf of the trust; and

(2) Regardless of whether the instrument by which the trustee or trustees acquired title

transferred that title to the trustee or trustees as such, or purportedly to the trust.

(d) The trustee or trustees of a trust may convey or otherwise transfer any ownership or security

interest in real or personal property as trustee or trustees even though the deed or instrument by

which the trustee or trustees acquired title purported to convey or transfer that title to the

trust.

(e) Nothing in this section shall be construed to limit the manner in hich title to real

or personal property may be conveyed or transferred to or by trustees.